Before embarking upon or undertaking housing finance, the banks/DFIs shall implement/follow the Prudential Regulations contained in this document.

House Financing Policy

Banks/DFIs shall have a comprehensive house financing policy, separate or as a part of overall credit policy, duly approved by their Board of Directors (in case of foreign banks, Country Head and by Executive/Management Committee; however, if Country Head is also member of Executive/Management Committee then no separate approval of his/her is required). The policy shall explicitly specify the functions, responsibilities and various staff positions’ powers/authority relating to approval/sanction of housing financing facility.

For every type of housing finance activity, the banks/DFIs shall develop a specific program that shall include the objective/quantitative parameters for the eligibility of the borrower and determining the maximum permissible limit per borrower. Banks/DFIs shall determine the housing finance limits, both in urban and rural areas, in accordance with their internal credit policy, credit worthiness and repayment capacity of the borrowers. Banks/DFIs should keep in consideration that this facility should not be used for speculative purposes and banks’/DFIs’ policies and other procedures should be so designed to discourage, to the extent possible, any speculative intent.

Promotion and Development of Housing Finance

Banks/DFIs are encouraged to develop floating, fixed and hybrid rate products for extending housing finance, suiting to varied needs of borrowers. Switching over from one type of rate to another unilaterally by the banks/DFIs to the disadvantage of customer should not be done. They are also encouraged to enhance housing finance outreach through increasing the areas and the number of branches offering housing finance particularly at small towns and cities of the county. Banks/DFIs shall explore the ways and means of broadening their product base beyond the prevalent housing finance products. For effective house financing, banks/DFIs shall develop strategies that will elaborate measures on improving delivery channels (branchless banking, tele-marketing etc.), adoption of credit scoring technology, improved understanding of the target market through field work and research, and putting in place strong marketing and sales culture.

Risk Management and Internal Control Systems

Banks/DFIs shall ensure strict compliance with laid down policies and procedures developed internally by them as well as those promulgated by SBP from time to time. The management of the banks/DFIs, under the guidance of Board of Directors, is required to establish systems, policies, procedures and practices to define and manage risks, stipulate responsibilities, specify security requirements, and design and implement internal controls. Risk management framework of banks/DFIs should appropriately cover housing finance.

Development of Financing Documentation

The banks/DFIs shall prepare standardized set of borrowing/financing and recourse documents (duly cleared by their legal counsels) comprising of financing agreement, application form and the other requisite supplementary financing documents. Banks/DFIs should obtain the thumb impression(s) along with borrower’s signature(s) on these documents. Further, these documents should clearly spell out all the terms and conditions of housing finance. Banks/DFIs should provide the copies of these documents to customers. The banks/DFIs are also encouraged to provide the terms and condition in Urdu language for better understanding of the customers and read out the same to the customers before finalizing the documentation process.

Title Documents

Banks/DFIs shall obtain all title and ownership related property documents from customers and shall get these documents vetted by their legal department/advisor(s). Banks/DFIs shall provide a signed copy of the list of all title and property documents to the borrower.

Management Information System (MIS) and Reporting

Banks/DFIs shall ensure adequate hardware, software, logistics support and strong IT infrastructure for effective and efficient monitoring of housing finance portfolio.

For effective monitoring and reporting purposes, banks/DFIs shall maintain, with respect to each financing transaction, necessary information/data which may include financing ID, original financing term, remaining term to maturity, CNIC/NTN number of the borrower, age of borrower, original financing balance & remaining financing balance, monthly principal & mark-up, benchmark, credit spread, payment frequency, mark-up rate type (fixed or floating), frequency of revision of mark-up rate, financing to value ratio, geographic region, appraisal value, appraisal date, appraiser name, property type, purpose of housing finance etc.

In addition to above, the MIS is expected to generate the following periodical reports:

-

Delinquency reports (for 30, 60, 90, 180 days, one year and two years and above) on monthly basis.

-

Reports interrelating delinquencies with various types of customers or various attributes of the customers to enable the management to take important policy decisions and make appropriate modifications in the financing program.

The banks/DFIs shall ensure that their accounting and computer systems are well equipped to avoid charging of mark-up on mark-up. For this purpose, it should be ensured that the mark-up charged on the outstanding amount is kept separate from the principal. The banks/DFIs shall ensure that any repayment made by the borrowers is accounted for before applying mark-up on the outstanding amount.

Information to Borrowers

Banks/DFIs shall ensure that the applications for house financing are processed expeditiously and shall provide following information to borrowers:

-

A true copy of the signed finance agreement(s).

-

Written notification of any change in repayment schedule in line with terms of the agreement.

-

Statement of accounts, on annual basis, detailing the principal repayments, principal outstanding, mark up/profit payments, and penalties (if any) during the year (may be made available on-line as well).

All the components of fees/costs shall be explicit and transparent and shall be disclosed before the transaction is initiated. There should be no hidden charges. For ease of reference and guidance of their customers, banks/DFIs shall publish brochures on frequently asked questions.

Banks/DFIs are, inter alia, encouraged to provide basic information on-line and through marketing material of housing finance facilities to the borrowers and regularly upgrade the housing finance section of their websites by providing necessary information for various stake-holders.

Banks/DFIs shall also provide, if requested by the borrower, additional statement(s), charges for which may not exceed the amount as advised by SBP from time to time for provision of duplicate/additional Statement of Account (SOA) to account holders.

Information Disclosure

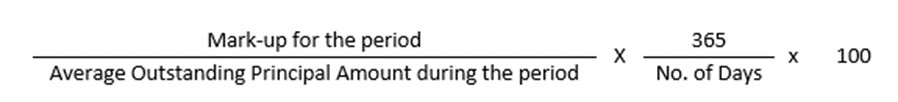

Banks/DFIs shall clearly disclose, all the important terms, conditions, fees, charges and penalties, which inter-alia include annualized percentage rate, pre-payment penalties and the conditions under which they apply. For the purposes of this regulation, Annualized Percentage Rate means as follows:

Confidentiality of Information

All information of a customer provided by him/her shall be kept confidential (even when the borrowers have settled their financings and no longer have relationship with the bank/DFI). Information of borrower can be shared with credit information provider under the relevant provisions of the Banking Companies Ordinance, 1962.

Credit Information

The financing profile of all intended borrowers shall be supplemented with credit report from the consumer credit information bureau of State Bank of Pakistan. In addition, the banks/DFIs may also obtain report from any other reliable bureau. At the time of granting facility under various modes of housing finance, banks/DFIs shall obtain a written declaration from the borrower divulging details of various facilities already obtained from other banks/DFIs.

Facilities to Related Persons

The housing finance facilities extended by banks/DFIs to their Directors, major shareholders, employees and family members of these persons shall be at arm’s length basis and on normal terms & conditions applicable for routine customers of the banks/DFIs. The banks/DFIs shall ensure that the appraisal standards are not compromised in such cases. However, this condition shall not apply to the house financing allowed by the banks/DFIs to their employees as part of compensation package provided the detailed terms and conditions of the benefits which the banks/DFIs want to give to their employees are specifically mentioned in the Employees Service Rules/HR Policy, approved by the Board of Directors. Further, such consumer financing to the employees should be treated as staff financing and not as general consumer financing. In case of resignation/separation/termination, staff housing finance should be monitored and serviced as commercial housing finance.

Asset Liability Mismatches

Banks/DFIs shall prudently manage the maturity mismatches arising out of their housing finance portfolios. Banks/DFIs are encouraged to explore avenues to generate long-term funds to finance the long-term housing finance products and develop in-house system to stress test their housing finance portfolios against adverse movements in mark-up/profit rates and asset-liability maturity mismatches.

Capacity Building

Capacity building programs/initiatives for all the officials attached with housing finance shall be held regularly to acquaint them with the systems, procedures, developments and best housing finance practices, prevalent within and outside Pakistan.

Monitoring of Housing Finance Market

The management of banks/DFIs shall put in place a mechanism to monitor conditions in housing finance market at least on half-yearly basis to ensure that their policies are aligned with current market conditions.

Verification of Property-related Documents

Banks/DFIs shall verify necessary information provided in the application form. In addition, all title and other legal documents provided with application form shall be verified directly from the relevant issuing authorities to establish their genuineness and authenticity as per banks’ internal policy. Property documents shall be clear and free from all encumbrances and legal charges. Title documents shall explicitly contain details of ownership as per relevant registration authorities, area and demarcation etc. All the documents should be kept in safe custody and meet all procedures/requirements relating to the completion of house finance.

Permission from Relevant Authorities

The banks/DFIs shall not disburse housing finance unless ensured that prior permission/clearance for construction and/or approved map of house has been obtained by the borrower from the relevant authorities, wherever required. In case of financing for purchase of a house/flat, it shall be ensured that the house/flat was constructed with prior permission/clearance from relevant authorities.

Insurance/Takaful

Banks/DFIs shall obtain comprehensive insurance/takaful coverage of the housing unit financed through a reputable insurance/takaful company. Banks/DFIs shall obtain insurance upto full value in case of apartment and upto construction cost in case of house. Further, banks/DFIs are allowed to obtain group insurance, life insurance or key-man insurance to minimize insurance cost. Further, banks/DFIs are advised to explicitly disclose the nature & type of insurance/takaful being obtained and rate of commission and other charges.

Recovery Procedures

Banks/DFIs should ensure that adequate procedures, systems and manpower are in place to efficiently handle the recovery process of default amount and successful execution and accomplishment of the auction proceedings wherever necessary, in accordance with the procedures and articles laid down in the Financial Institutions (Recovery of Finances) Ordinance, 2001 (FIRO-2001) and other provisions/clauses, amendments in FIRO-2001 or any law/regulations in force and SBP instructions issued from time to time.

Regulation HF 2 Types of Housing Finance

-

Banks/DFIs may provide following types of housing finance to borrowers

-

Purchase, construction, renovation or extension of residential units to individuals, co-borrowers including non-resident Pakistanis.

-

Financing for residential plots plus construction.

-

Balance transfer of existing finance facility of borrower from other banks/DFIs, subject to the condition that the bank/DFI where facility is transferred would not extend financing higher than the balance amount in the transferring bank/DFI. Further, borrower cannot transfer housing finance to other banks/DFIs before completion of eighteen (18) months with a bank/DFI as a mortgagee.

-

For Solar Energy Solutions to be installed for residential use, banks/DFIs are allowed to extend financing for a maximum period of ten years against any security arrangement as per their credit and risk management policies in addition to hypothecation of asset. Such financing shall be treated as home improvement/renovation financing for reporting purposes.

-

Banks/DFIs shall not allow housing finance purely for the purchase of land/plots; rather, such financing would be extended for the purchase of land/plot and construction on it. Accordingly, the sanctioned financing limit, assessed on the basis of repayment capacity of the borrower, value of land/plot and cost of construction on it etc., shall be disbursed in tranches, i.e. upto a maximum of 50% of the financing limit can be disbursed for the purchase of land/plot (however the amount disbursed for purchase of plot must not exceed the 85% of the market value/cost of land/plot), and the remaining amount be disbursed for construction there-upon. Further, the bank/DFI will take a realistic construction schedule from the borrower before allowing disbursement of the initial financing for construction. For construction-only cases, the sanctioned financing shall also be released in tranches commensurate with the stage of construction. Moreover, if an individual gets construction finance and there is cost overrun due to which property remains incomplete, banks/DFIs may entertain the customer for additional finance for completion of house, keeping in view the DBR and cushion in overall Loan-to-Value (LTV) ratio.

-

Further, if there is sufficient cushion available as per valid valuation/revaluation, banks/DFIs may consider providing additional finance for renovation or extension but not before two (02) years of the last finance availed by the borrower for the same house. However, financing for Solar Energy Solutions only can be extended before the completion of two (02) years from the date of last finance availed by the borrower for the same house. The requirements regarding debt burden ratio and LTV ratio shall be duly observed while allowing such financing.

Regulation HF 3 Debt Burden Ratio

Total monthly amortization payments, including the housing finance under consideration and repayment obligations against all other consumer financings, should not exceed 50% of the net disposable income of the prospective borrower. In case any financing of the borrower requires quarterly, bi-annual or annual payments, the debt burden ratio shall be calculated by assuming that the financing is repaid in substantially equal monthly payments during its term. While calculating net disposable income, verifiable income of the borrower and repayment capacity should be taken into account. The income of co-borrower can be clubbed after his/her written consent.

The above measures would be in addition to banks’/DFIs’ usual evaluations of each proposal concerning credit worthiness of the borrowers to ensure that the banks’/DFIs’ portfolio under housing finance fulfills the prudential norms and instructions issued by the State Bank of Pakistan and does not impair the soundness and safety of the bank/DFI itself. They shall maintain record evidencing assessment of repayment capacity of the borrower.

Regulation HF 4 Loan to Value Ratio

The housing finance shall be provided at a maximum Loan to Value ratio of 85:15.

Regulation HF 5 Limit on Exposure against Real Estate Sector

-

The banks/DFIs shall not take exposure on the real estate sector exceeding 10% of the aggregate of their advances and investments (excluding investments in Government securities) at any point in time.

-

For the purpose of this regulation, Real Estate Sector shall include

-

a) Individual/family owned houses for the purpose of self-occupation or renting out (non-commercial usage).

-

b) Builders, developers, contractors, corporations, property dealers and any other person dealing in residential, commercial and industrial real estate, e.g., undeveloped land, housing societies/residential buildings, office buildings, multi-purpose commercial premises, hotels, shopping malls, retail space, retail store buildings, industrial space, factories, warehouses.

-

c) Subsidiaries of (b)

-

d) Debt instruments and shares issued by (b) and (c) above and units of Real Estate Investment Trusts (REIT) issued by a REIT Management Company.

-

In case of 2) b), such exposure shall be counted towards the above limit of 10% where the prospects for repayment and recovery in the event of default depend primarily on the cash flows generated by real estate.

-

Infrastructure Project Financing (IPF), as defined in the SBP’s guidelines for Infrastructure Project Financing as amended form time to time, shall not be included for calculating the above limit.

-

With a view to promote the low cost/ low income/affordable housing, financings under Government Housing Scheme and initiatives shall also be not included for calculating above limit.

The above criterion is, however, not applicable to the specialized housing finance companies like House Building Finance Company Limited as their core business is extending housing finance to the borrowers.

Regulation HF 6 Financing Tenor

The banks/DFIs shall not extend housing finance for a tenor exceeding 25 years. The duly approved financing policy of the banks/DFIs shall define the maximum tenor keeping in view maturity profile of their assets and liabilities. In case the financing is rescheduled/restructured, it should not result in extension in total tenor beyond 25 years.

Regulation HF 7 Property Assessment

Banks/DFIs shall ensure that a proper property valuation is done by a valuer on approved panel of Pakistan Banks Association and valuation report provides banks/DFIs with an in-depth assessment of the property that is being offered as security.

The housing finance upto Rs. 10 million should be subject to assessment of the property by at least one valuator listed on PBA approved panel and the housing finance above Rs. 10 million should be subject to assessment of the property by at least two valuators listed on PBA approved panel.

However, the properties valuing upto Rs. 3.0 million should not be subject to assessment by valuator. Banks/DFIs can use their internal resources to assess the properties having market value upto Rs. 3.0 million.

Regulation HF 8 Creation of Mortgage

The house/plot (for construction of house) financed by the bank/DFI shall be mortgaged in bank’s/DFI’s favour by way of equitable or registered mortgage.

Regulation HF 11 Rescheduling / Restructuring of Non-Performing Housing Finance

-

Banks/DFIs shall have policy for rescheduling/restructuring of non-performing housing finance, which should be approved by the Board of Directors or by the Country Head/Executive/Management Committee in case of branches of foreign banks.

-

Rescheduling/restructuring should not be done just to avoid classification of financing and provisioning requirements. In this connection, banks/DFIs shall ensure that house financing facilities of any borrower should not be rescheduled/restructured more than once within two years.

-

For the purpose of rescheduling/restructuring, banks/DFIs may change the tenure of the financing by maximum two years beyond the original tenure agreed with the customer subject to maximum financing tenure of 25 years.

-

While considering rescheduling/restructuring, banks/DFIs should, inter alia, take into account the repayment capacity of the borrower. The condition of 50% of Debt Burden Requirement (DBR) shall not be applicable to financing rescheduled/restructured. However, any new house financing facility extended to a borrower who is availing any rescheduled/restructured facility shall be subject to observance of minimum DBR.

-

The status of classification of the non-performing assets shall not be changed because of rescheduling/restructuring unless borrower has paid at least 10% of the rescheduled/restructured amount (including principal and mark-up both) or six installments as per terms & conditions of the rescheduling/restructuring whichever is high. However, for internal monitoring purpose, banks/DFIs may re-set the dpd (days past due) counter of the newly created finance to “0” dpd.

-

Provisions already held against non-performing financing, to be rescheduled/restructured, will only be reversed if condition of 10% recovery or six installments is met.

-

If the borrower defaults (i.e. reaches 180 dpd) again within two years after declassification, the financing shall be classified under the same category in which it was prior to rescheduling/restructuring. Banks/DFIs, however, at their discretion may further downgrade the classification based on their own internal policies.